“Stories and lessons from an unexpected journey in finance.”

For years, I felt like the odd one out. In a sea of CPAs and Big Four veterans, I didn’t fit the mold. I didn’t spend my early career exclusively modeling spreadsheets. I was an “Accidental” finance leader.

I used to view this as a handicap to hide. Now, I realize it’s my greatest asset.

The Blind Spot of Traditional Finance Traditional training teaches you to manage results: P&Ls, cash flow, compliance. These are non-negotiable. However, living inside a spreadsheet creates tunnel vision. You see the what (numbers) but miss the why (operations).

Relying on lagging indicators means that by the time a risk hits the quarterly report, the damage is often already done.

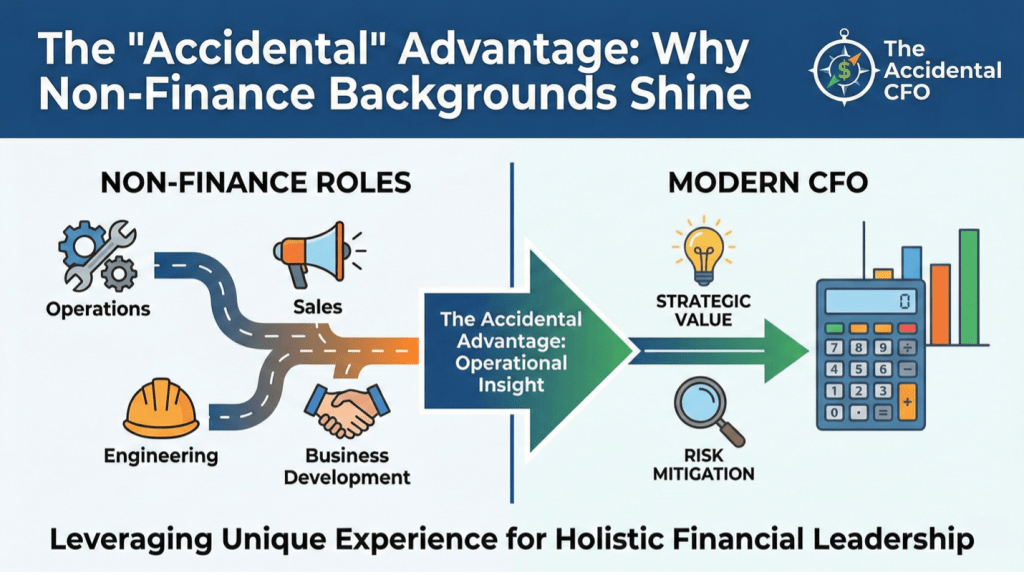

The “Accidental” Perspective: Operational Empathy. My time in the trenches, dealing with broken supply chains and frustrated teams, helps me spot risks that don’t look like risks on a balance sheet yet.

Here is where the “Accidental” advantage shines:

- Spotting Cultural Burnout: A traditional CFO sees headcount reduction as an “efficiency win.” I see a team stretched thin. If morale collapses, turnover costs dwarf those temporary savings.

- Identifying Process Fragility: On paper, the lowest vendor price is a victory. But having “been there,” I spot the risk of single points of failure. I look for resilience, not just margin.

- Translating Strategy: I don’t just ask, “Can we afford this?” I ask, “Can we execute this without breaking the business?”

Seeing the Story Behind the Numbers To be a true strategic partner, you need operational empathy. You need to understand friction in the warehouse and technical debt in engineering.

If you have a non-traditional background, stop apologizing. Your experience provides a 360-degree view academic finance simply can’t replicate. You don’t just count the beans; you know how they are grown.

I’d love to hear from you: Did you take a “traditional” path, or was your journey more “accidental”?

#TheAccidentalCFO #inersec #OperationalExcellence #CareerJourney #BusinessStrategy

Leave a comment