“Stories and lessons from an unexpected journey in finance.”

A reader recently left a comment on my last post that stopped me in my tracks: “Ambiguity doesn’t disappear with better data, it only shifts.”

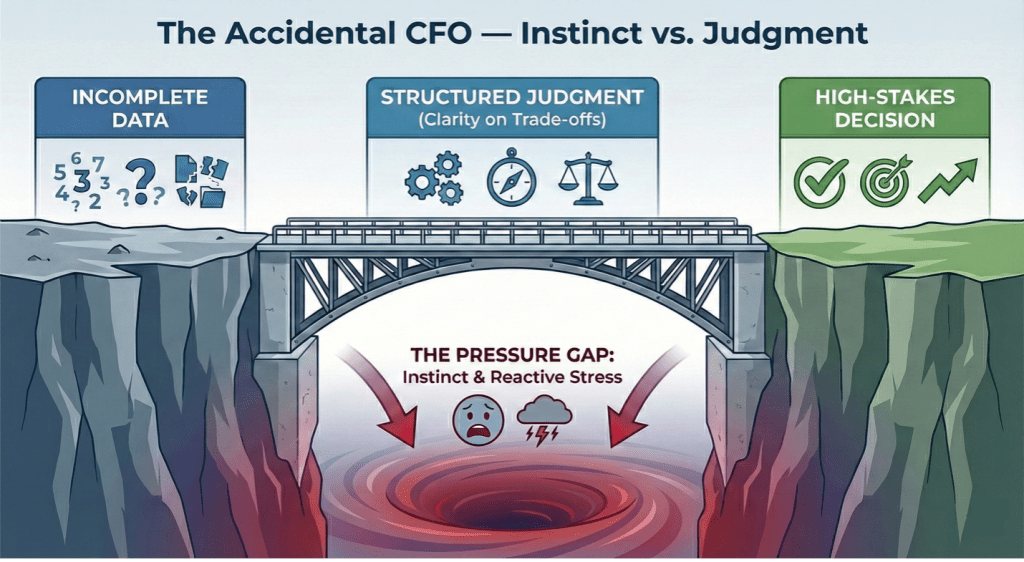

They pointed out that when a leader fails to provide clarity on direction and trade-offs, a “pressure gap” forms. And in that gap, decisions stop being made on judgment and start being made on instinct.

In finance, we often conflate the two. But the difference is what separates a reactive manager from a strategic leader.

1. Instinct is Reactive; Judgment is Intentional

- Instinct is that “gut feeling” triggered by stress. It’s often a desire to make the pressure go away (e.g., “We need to cut costs immediately!”).

- Judgment is the ability to look at incomplete data, acknowledge the holes, and say, “Based on these three assumptions, this is the most logical path forward.”

2. Instinct is Internal; Judgment is Communal

- Instinct lives in the CFO’s head. It’s hard to explain, which makes it hard for a team to follow. It leads to “because I said so” leadership.

- Judgment is explicit. When you document your assumptions and the trade-offs you’re willing to accept, you give your team a roadmap. They don’t have to guess what you’re thinking; they just have to execute the framework.

3. The “Pressure Gap”

When data is messy and the board is waiting, the “pressure gap” is at its widest. If you don’t fill that gap with clarity of direction, your team will fill it with anxiety. They’ll stall, they’ll over-analyze, or they’ll make “safe” decisions that don’t actually move the needle.

The CFO’s job isn’t to be a human calculator. It’s to be a clarity creator.

We don’t wait for the ambiguity to vanish, we structure it. We define the trade-offs, name the risks, and turn “gut feelings” into “informed hypotheses.”

That is how you move a team from paralysis to momentum.

💡 I’m curious: How do you catch yourself when you’re leaning too hard on “instinct” instead of “judgment”? Is there a specific question you ask yourself to get back to a structured framework?

#CFO #Leadership #inersec #DecisionMaking #TheAccidentalCFO

Leave a comment