Stories and lessons from an unexpected journey in finance.

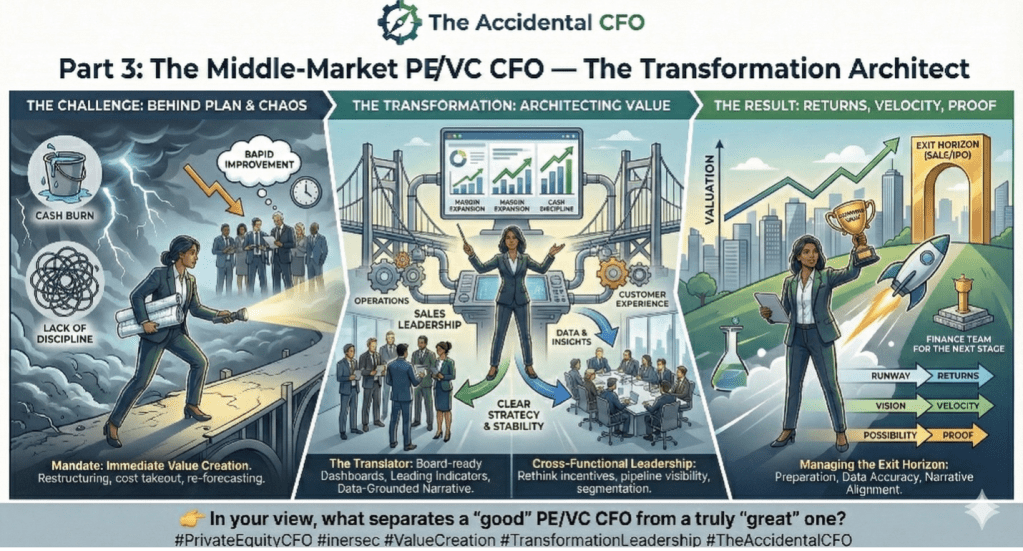

If startups require building from scratch and public companies require navigating scale, the PE/VC-backed middle market sits in the most demanding place of all: transformation.

In these environments, I’ve often been brought in when the business is behind plan, burning cash, or lacking operational discipline. Sometimes all three. The investors want rapid improvement, the leadership team wants clarity, and the organization wants stability. The CFO sits at the intersection of those pressures.

The mandate is immediate value creation.

In one role, the first 90 days involved restructuring, cost takeout, re-forecasting, and stabilizing liquidity. There’s no luxury of time—your work needs to materialize in the numbers quickly. The CFO becomes the driver of margin expansion, cash discipline, and strategic prioritization.

The metrics change, too.

It shifts from “runway” to “returns.”

From “vision” to “velocity.”

From “possibility” to “proof.”

The CFO becomes the translator between operations and investors.

Boards want crisp dashboards, leading indicators, and a clear story on value creation. I’ve spent countless hours helping CEOs articulate what’s working, what isn’t, and what must change—grounded in data, not hope.

Transformation demands cross-functional leadership.

In one company, improving customer experience wasn’t just an ops issue—it required pricing fixes, CM improvements, and a complete rebuild of the forecasting model. In another, driving revenue growth involved partnering deeply with sales leadership to rethink incentives, pipeline visibility, and segmentation.

You also build the finance team for the next stage.

Most middle-market companies have thin finance organizations—great people, but stretched. The CFO has to upskill, restructure, and often recruit while simultaneously producing investor-grade reporting.

Finally, you manage the exit horizon.

Whether it’s a recap, a sale, or IPO prep, everything is tied to valuation. I’ve led sale processes where preparation, data accuracy, and narrative alignment created hundreds of millions of dollars of enterprise value. No stage tests a CFO’s impact more directly.

The PE/VC CFO must be both strategic and operational, equally comfortable in boardrooms and within the details. It’s demanding—but incredibly rewarding when executed well.

👉 In your view, what separates a “good” PE/VC CFO from a truly “great” one?

#PrivateEquityCFO #inersec #ValueCreation #TransformationLeadership #TheAccidentalCFO

Leave a comment