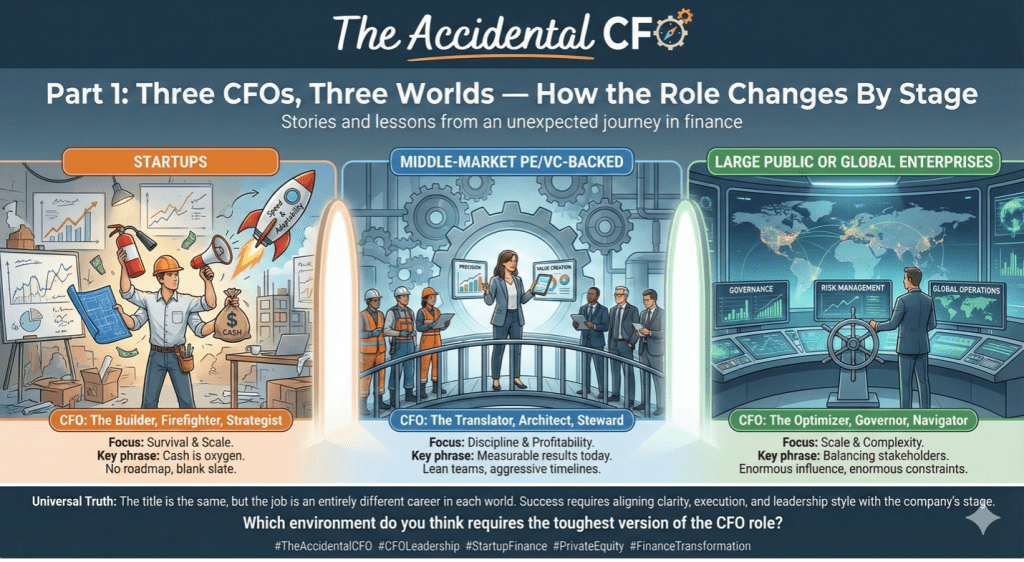

Stories and lessons from an unexpected journey in finance.

If there’s one universal truth about the CFO role, it’s this: the title may stay the same, but the job absolutely does not.

Over nearly three decades across startups, PE-backed middle-market businesses, and multi-billion-dollar global enterprises, I’ve learned that a CFO’s world is completely shaped by the environment they serve. The challenges shift, the skills required shift, and even the definition of “value” shifts. What looks like the “same job” on paper turns into three entirely different careers in practice.

Startups:

You are the builder, firefighter, strategist, and chief stabilizer—often all before lunch. There were times when I stepped into a high-growth venture-backed organization and found a blank slate: no budgeting discipline, no true cash forecasting, limited reporting, and a product roadmap changing weekly. The CFO isn’t just plugging in a financial system—you’re building the muscle that keeps the company alive long enough to scale. Speed and adaptability matter more than perfection. Cash is oxygen.

Middle-Market PE/VC-backed companies:

Here, the job becomes about precision, repeatability, and value creation. When I was parachuted into underperforming businesses or rapidly scaling portfolio companies, the mandate was clear: build discipline, improve profitability, and create transparency for investors. You’re working with lean teams, aggressive timelines, and investors who want measurable results today—not in six months. You become the translator between operations and the board, the architect of transformation, and the steward of value.

Large Public or Global Enterprises:

Suddenly, scale and complexity are the defining forces. During my years leading large multi-national divisions, everything revolved around governance, risk management, scenario planning, and steering multibillion-dollar portfolios. The CFO becomes less about creating the system and more about optimizing a vast one—balancing stakeholder expectations, market scrutiny, regulatory demands, and global operations. The influence is enormous, but so are the constraints.

Across these three worlds, one thing has remained constant: the CFO role succeeds when it aligns clarity, execution, and decision-making with the company’s true stage of maturity. The mistake many CEOs and boards make is assuming a “great CFO” is automatically great everywhere. They’re not. Each stage requires different instincts, muscles, and leadership styles.

Over the next two weeks, this series will break down each world through lessons I’ve lived, scars I’ve earned, and transformations I’ve led.

👉 Which environment do you think requires the toughest version of the CFO role—and why?

#TheAccidentalCFO #CFOLeadership #StartupFinance #PrivateEquity #inersec

Leave a comment