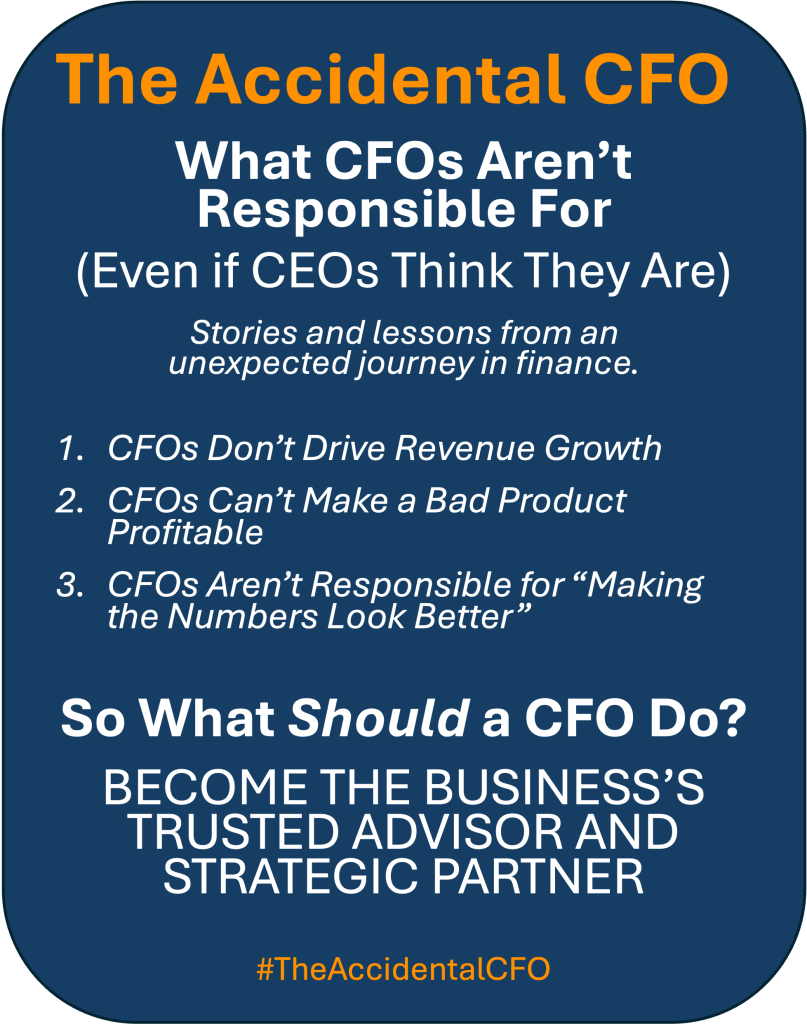

𝘚𝘵𝘰𝘳𝘪𝘦𝘴 𝘢𝘯𝘥 𝘭𝘦𝘴𝘴𝘰𝘯𝘴 𝘧𝘳𝘰𝘮 𝘢𝘯 𝘶𝘯𝘦𝘹𝘱𝘦𝘤𝘵𝘦𝘥 𝘫𝘰𝘶𝘳𝘯𝘦𝘺 𝘪𝘯 𝘧𝘪𝘯𝘢𝘯𝘤𝘦.

One big misconception, especially in high-growth companies, is that the CFO owns every number the business produces. Revenue stalls? Finance. Margins compress? Finance again. Product not converting? Surely the CFO can “model something.”

After nearly three decades in the seat, much of it by accident, here’s the truth: CFOs create financial clarity, not financial miracles. And there are a few things CEOs routinely assume sit on the CFO’s desk—but don’t.

1. CFOs Don’t Drive Revenue Growth

They model it.

They forecast it.

They fund it.

They evaluate its ROI.

But they don’t create it.

If sales tank, that’s a product, marketing, or distribution issue—not finance. Revenue comes from a strong value proposition, effective marketing, differentiated offerings, and a scalable sales engine. Finance fuels growth; it doesn’t generate demand.

2. CFOs Can’t Make a Bad Product Profitable

Cost cuts and reorganizations are useless if the product isn’t wanted. Weak retention or rising CAC signal a value-prop issue, not a balance-sheet one. Finance clarifies unit economics, but it cannot manufacture Product-Market Fit.

3. CFOs Aren’t Responsible for “Making the Numbers Look Better”

Great CFOs don’t smooth ARR, inflate pipeline confidence, or shift revenue for optics.

That’s not stewardship. It’s sabotage.

A CFO reports reality early, especially when it’s inconvenient.

So What Should a CFO Do? Become the Business’s Trusted Advisor and Strategic Partner

This is where the best CFOs earn their seat.

While CFOs aren’t responsible for driving every outcome, they are responsible for elevating every leader who does. The modern CFO serves as the business’s strategic partner— not just to the CEO, but to product, sales, marketing, engineering, operations, and the board.

A strategic CFO:

- Connects financial signals to operational realities

- Helps leaders see around corners with data-driven insight

- Guides prioritization when resources are limited

- Challenges assumptions with diplomacy and courage

- Brings cross-functional clarity to complex decisions

- Builds organizational trust by being objective, balanced, and consistent

The best CFOs don’t run every function—they enable every function to make smarter, faster, more aligned decisions.

When companies treat CFOs as miracle workers, they get frustration.

When they treat CFOs as trusted advisors, the whole business accelerates.

👉 Which of these misconceptions have you seen most often, and what impact did it have?

#TheAccidentalCFO #CFOLeadership #FinanceTruth #inersec #ValueCreation

Leave a comment