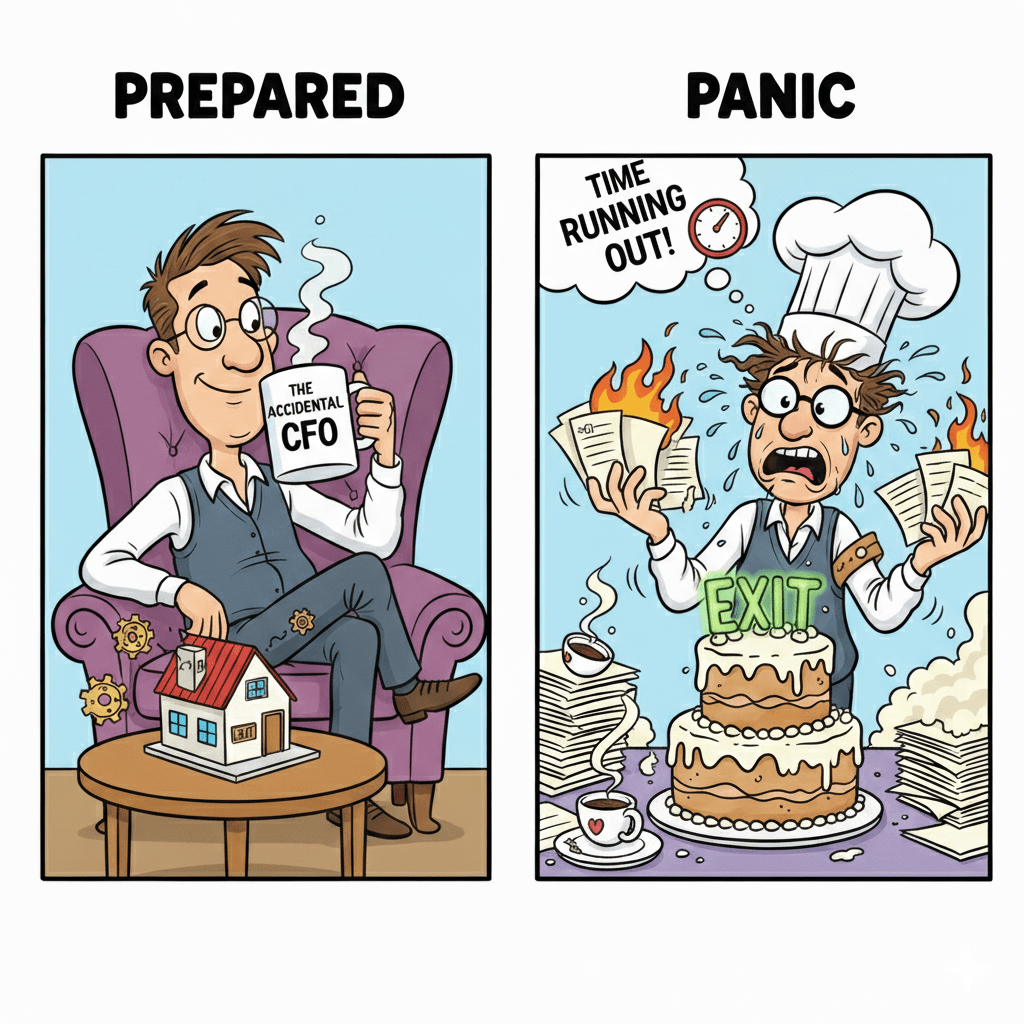

“Stories and lessons from an unexpected journey in finance.”

If there’s one truth every CFO learns, it’s this: you don’t become exit-ready when the banker shows up—you become exit-ready years before anyone says “process.” Most founders and boards underestimate how long the runway needs to be. Buyers don’t just want strong performance; they want sustained, predictable, defensible performance.

I never planned to become an “exit CFO.” Like many, I stumbled into the seat. But after multiple exits, integrations, and rescues, I’ve earned the deal scars—and learned the work starts long before the first teaser deck.

1. Exit Readiness Is an Operating System, Not an Event

Most companies need 2–3 years to prepare for a transaction. It takes time to clean data, fortify forecasting, implement processes, and embed KPIs that withstand scrutiny. If your monthly close depends on heroics and fragile spreadsheets, you’re not preparing for an exit—you’re preparing for turbulence.

2. Your Equity Story Matters as Much as Your EBITDA

A strong exit isn’t just about numbers—it’s the narrative behind them. Buyers want to know where the business is heading and why the path is believable. The best CFOs create the conditions for competitive bidding by telling that story with clarity and conviction.

3. Interim CFOs Aren’t a Red Flag—They’re a Strategic Lever

Many companies bring in interim CFOs with deep transaction experience—not because something is broken, but because experience accelerates outcomes. They act as crisis managers, fresh eyes, mentors, and transformation catalysts. When a deal wobbles, they steady the ship and rebuild trust.

4. What Makes a Great Exit CFO?

They combine:

• Experience navigating transactions and avoiding value leakage.

• Communication that inspires confidence under pressure.

• Adaptability to tailor the narrative for strategic or PE buyers.

5. Exit Readiness Is Value Creation in Disguise

Everything you do to prepare for an exit—cleaning data, strengthening processes, implementing systems, driving discipline—makes the business stronger even if you never sell.

Exit readiness is the final exam.

The real work happens long before it.

So ask yourself:

👉 If a buyer called tomorrow, would we be ready—or scrambling?

#TheAccidentalCFO #ExitReadiness #ValueCreation #FinanceTransformation #inersec

Leave a comment