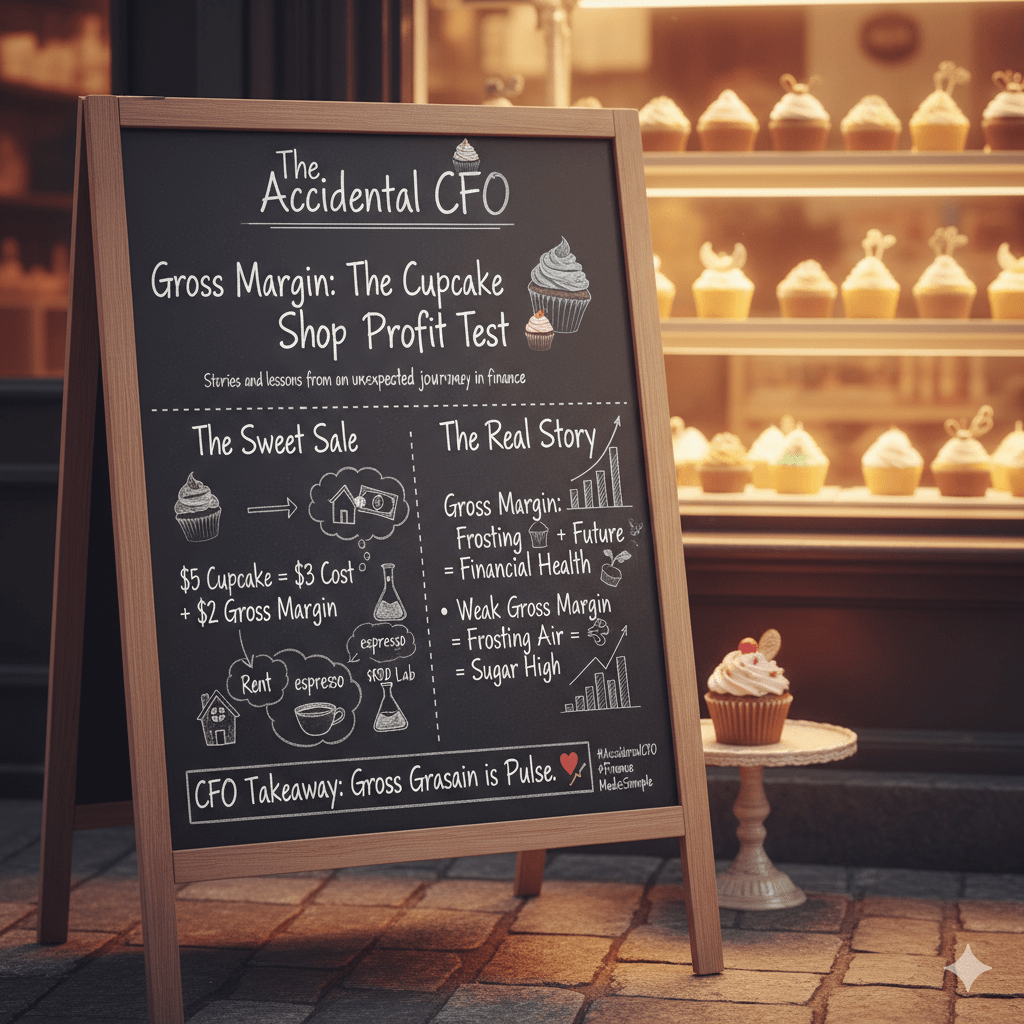

“Stories and lessons from an unexpected journey in finance.”

Let’s say you open a cupcake shop. You sell each cupcake for $5 — because obviously, these aren’t your run-of-the-mill cupcakes. They’re small works of art, made with imported vanilla, Himalayan salt, and frosting whipped by hand while listening to motivational podcasts.

Now, let’s talk about what it costs to make that $5 masterpiece. The flour, sugar, butter, frosting, box, and that sprinkle of edible glitter cost you $3.

That means your gross margin is $2.

Simple, right? You’re making $2 on every cupcake you sell. Except… you’re not — not really. Because that $2 has a long list of other jobs before it can become “profit.” It needs to pay for your rent, electricity, payroll, delivery van, marketing, insurance, your espresso habit, and of course, that flavor innovation lab you built in the back (you know, for R&D purposes).

This is where most founders, and even some seasoned operators, confuse revenue growth with financial health. Gross margin is your first line of defense — the metric that tells you whether you’re making enough money on each sale to sustain everything else that comes after.

A healthy gross margin means you’re building value with every transaction. You’re generating enough contribution per sale to fuel operations, growth, and the occasional frosting experiment.

A weak gross margin, on the other hand, is like frosting air. It looks sweet on the outside, but there’s nothing underneath to hold the structure. The business might grow, but it won’t scale sustainably — every new sale just digs the hole deeper.

When I look at a business, one of the first questions I ask is, “What’s your gross margin story?” Because gross margin tells me almost everything I need to know about business model health — pricing power, cost structure, efficiency, and even how disciplined the leadership team is about value creation.

So here’s the Cupcake Shop Test:

If your gross margin can’t fund both the frosting and the future, you’ve got a problem.

Because if every sale makes you hungrier instead of richer, that’s not growth — it’s a sugar high.

💡 The Accidental CFO Takeaway:

Gross margin isn’t just a number on a P&L — it’s the pulse of your business model. When it’s strong, every sale adds fuel to the mission. When it’s weak, every sale accelerates the burn.

Question for you:

What’s your version of the “cupcake test”? What’s the simple, no-excuses metric that tells you whether a business is healthy or just running on sugar?

#AccidentalCFO #FinanceMadeSimple #GrossMargin #BusinessStrategy #inersec

Leave a comment